The client

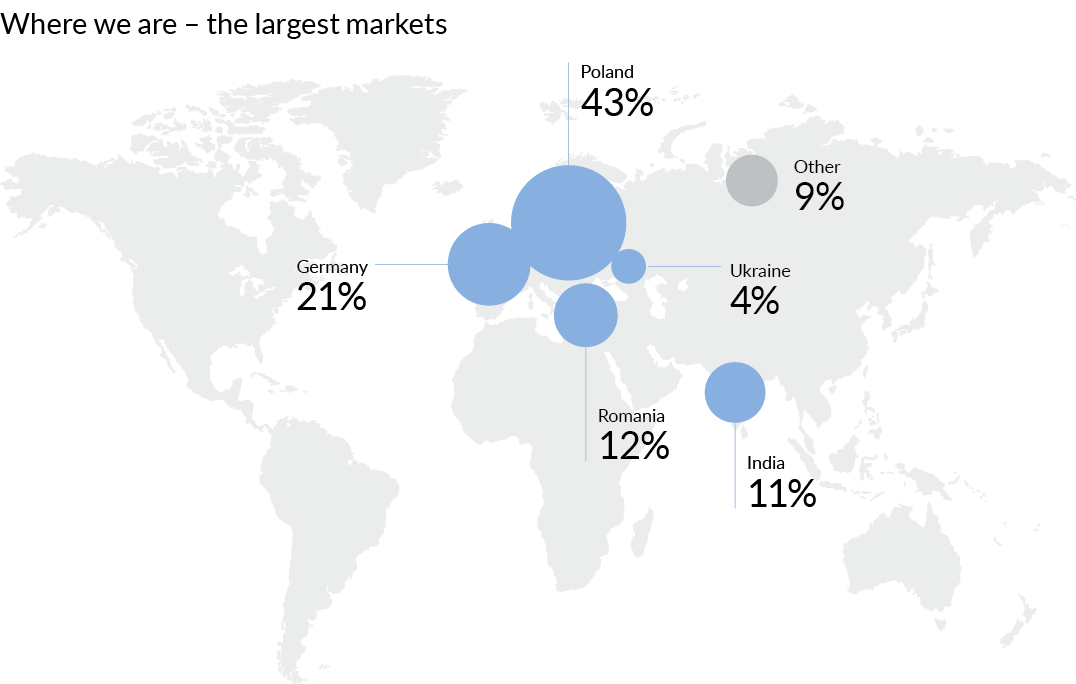

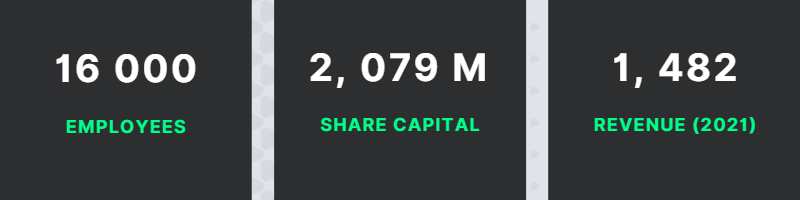

Medicover is a specialized provider of diagnostic and healthcare services, mainly focused on markets in Central, Eastern Europe and India. The company operates through two divisions – Diagnostic Services and Healthcare Services.

Visualization from official website: https://www.medicover.com/medicover-in-brief

Healthcare Services offers high-quality care based on an Integrated Healthcare Model and Fee-For-Service. The basis for this is a network of 32 hospitals and 129 medical centers, 64 dental clinics, 26 fertility clinics and 77 gyms.

Diagnostic Services provides a broad range of laboratory testing in all major clinical pathology areas. The business is conducted through a network of 99 laboratories, 852 blood-drawing points (BDPs) and 24 clinics.

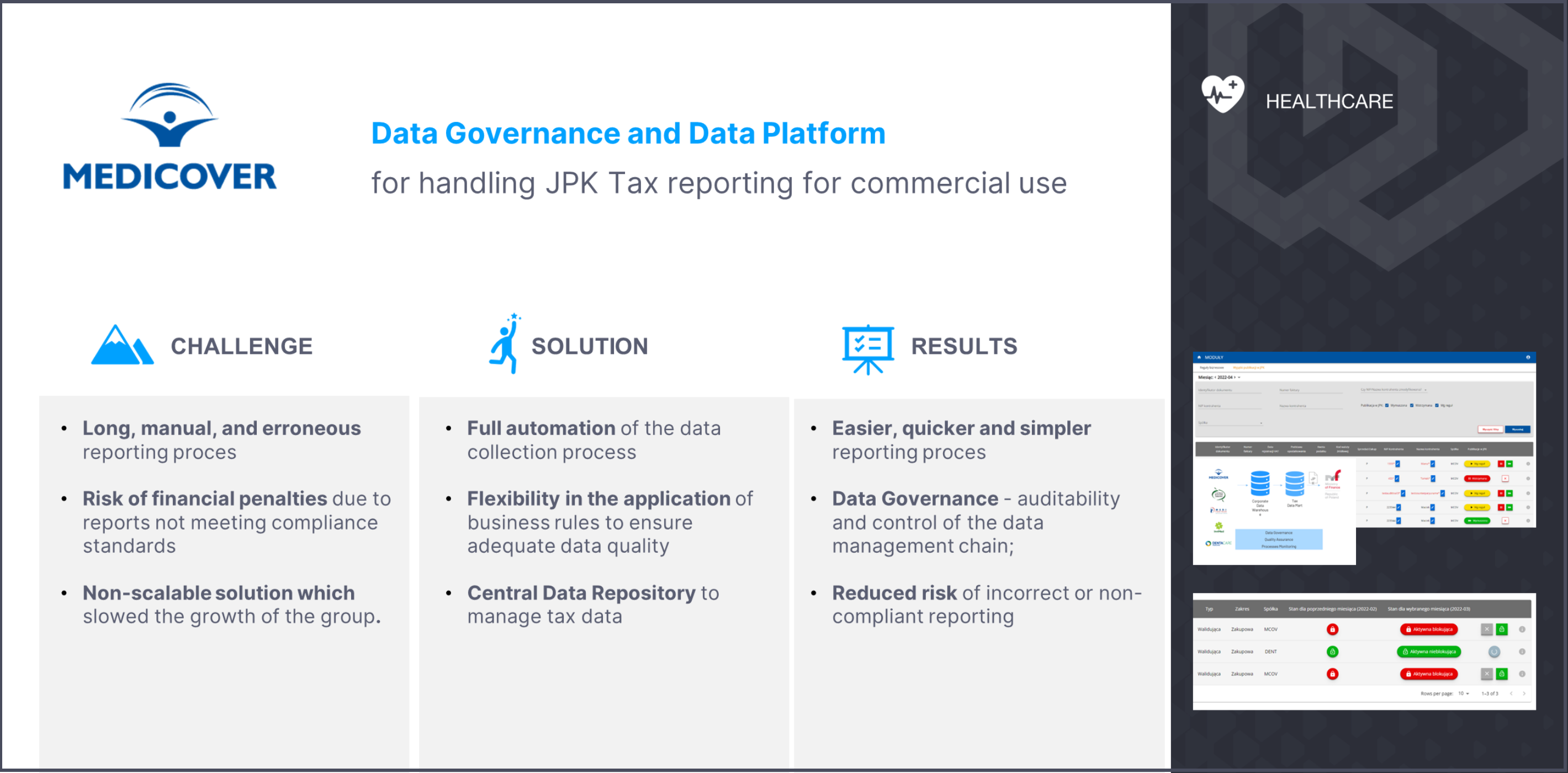

The problem

The monthly, obligatory financial reporting process was time-consuming and required advanced knowledge as well as many manual adjustments to fulfil constantly changing regulations from the Ministry of Finance.

The final financial data set, called Uniform Control File (JPK_VAT) was prone to errors and delays, which created a risk of heavy financial penalties. An additional difficulty was the constantly changing environment of financial and accounting applications – a result of the ongoing acquisitions conducted by the client.

The structure of the JPK_VAT data asset impeded analysis of data making scaling and development challenging.

The challenge

- The manual, erroneous and difficult reporting process, which required a significant amount of time and expertise to fulfil. This resulted in a large amount of resources used each month.

- The system had to be compliant with both financial regulations and data safety protocols, set and supervised by the national regulator for financial settlements (Ministry of Finance)

- The client’s aggressive business model and dynamic growth were largely based on acquisition, which made scalability, integration and unification of data structure in the group a priority.

The solution

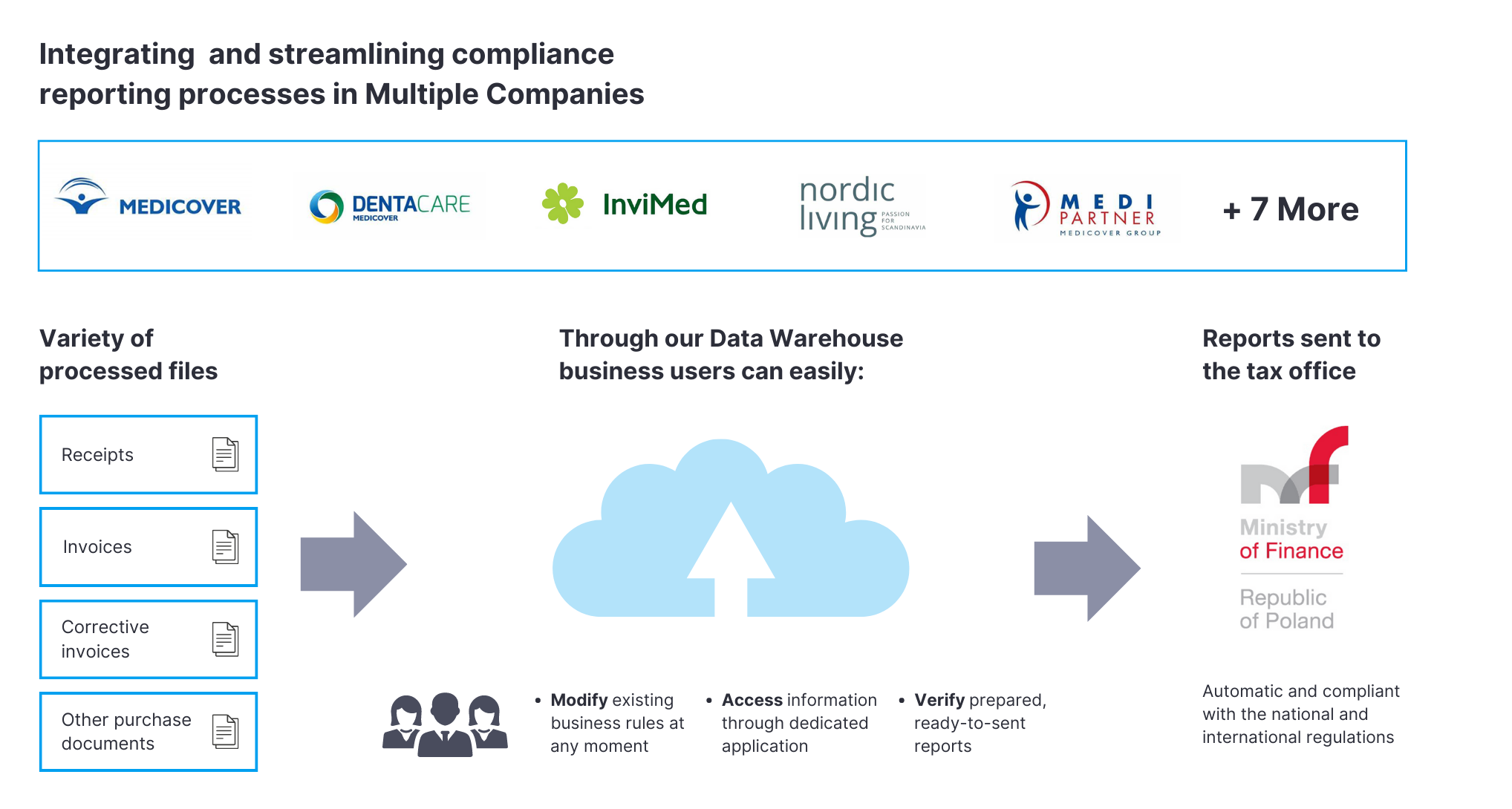

BitPeak provided the client with a Tax reporting system fulfilling JPK/SAFT compliance criteria and reduced to a minimum the time needed to meet regulatory duties. The tax team can finally focus on data analysis instead of manual and tedious data preparation. The system compiles monthly tax reports based on multilaterally sourced data and according to established business rules such as checking for the correct amount of digits in the NIP code or whether the invoiced company remains active. Those rules can be continuously modified through a user-friendly application, adapting to changing business environment

For auditing purposes, the solution provides a set of Power BI control reports, allowing the client to monitor data quality statistics on monthly JPK_VAT statements.

Step 1 – Acquiring a broad range of data from various source systems, and processing them – ensuring quality, compatibility and preventing data anomalies.

Step 2 – Based on the acquired data and established business rules the system automatically provides reports according to the latest compliance criteria.

Step 3 – The end product was automatically verified against previously filed reports, as well as internal and external regulations to detect any errors or anomalies, before being accepted by the supervisor and sent to the Ministry of Finance.

Additionally, through the use of Azure Purview, the client has a full overview of the flow of information as well as a repository of business rules and terms. Through analysis of this metadata, Data Governance is much easier and can be used to iteratively optimize the whole process.

Benefits:

Financial Data Strategy

We have changed the approach to managing the financial data by introducing the central data repository for obligatory as well as analytical reporting purposes. As a part of our solution, we provided our expertise in Data Governance to restructure the data system of our client and unify it among every subsidiary, ensuring uniform data integration. This resulted in the ability to easily scale or modify the solution – facilitating the future growth of the Medicover group.

Financial Department

Thanks to our system, each JPK File, was verified against not only governmental and internal regulations, but also against previous iterations of JPK. This minimized the amount of errors and delays which greatly reduced the risk of financial penalties that the department had to pay.

Employees

Previously, providing documentation, checking for errors and creating necessary files was taking a team of eight people, on average, one week per month. This translated to 1600 manhours spent on manual and exhausting tasks each month by highly qualified staff. Thanks to our solution, this task was largely automatized, which allowed the team to focus on new, more productive projects.

(+48) 508 425 378

(+48) 508 425 378 office@bitpeak.pl

office@bitpeak.pl